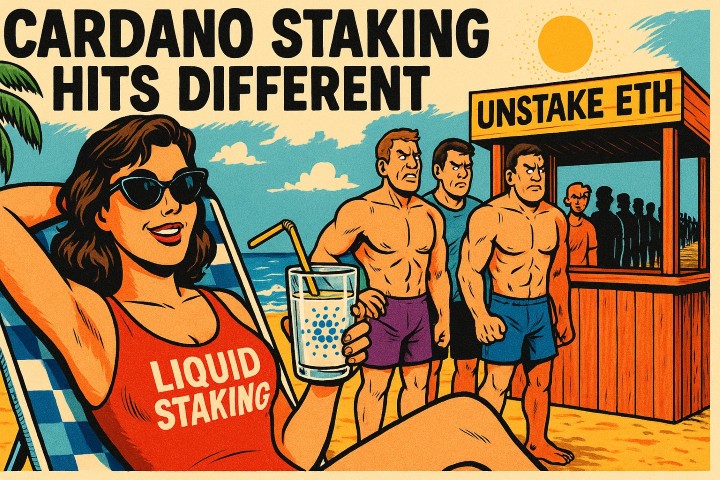

Let’s get one thing straight: regular staking is cute. You lock up your ETH, you earn rewards, you vibe.

But liquid staking with Cardano is next level!?

That’s like staking with your wallet open, your keys in the ignition, and your bags still mooning on-chain. You’re earning passive income AND staying fully liquid.

It’s like getting paid to hold… while also playing the game.

💧 So WTF Is Liquid Staking?

Before we talk about looping ADA through DeFi or flexing your on-chain liquidity, let’s clear something up: most people don’t actually know what staking is on Cardano.

Staking is not like earning interest at a bank.

It’s not a loan. Your ADA isn’t locked. Your stake pool doesn’t “use” it.

And you’re definitely not handing your keys to some centralized platform.

So what is it?

It’s a vote. A signal. A staking key signature that tells the Cardano protocol:

🗳 “I trust this pool to make blocks.”

And when enough people vote for a pool, it gets to produce blocks and earn rewards — which get shared back to you, proportionally.

You keep custody the entire time. You can spend your ADA anytime. The protocol just uses your balance to weight your vote every epoch.

Cardano rewards you because you’re helping keep the network secure, decentralized, and honest — not because you locked something up.

💡 Enter Liquid Staking (The Cardano Way)

Now imagine you could keep earning those sweet rewards — but also use your staked ADA in DeFi, or as collateral, or inside a smart contract… without un-delegating, unbonding, or waiting 21 days.

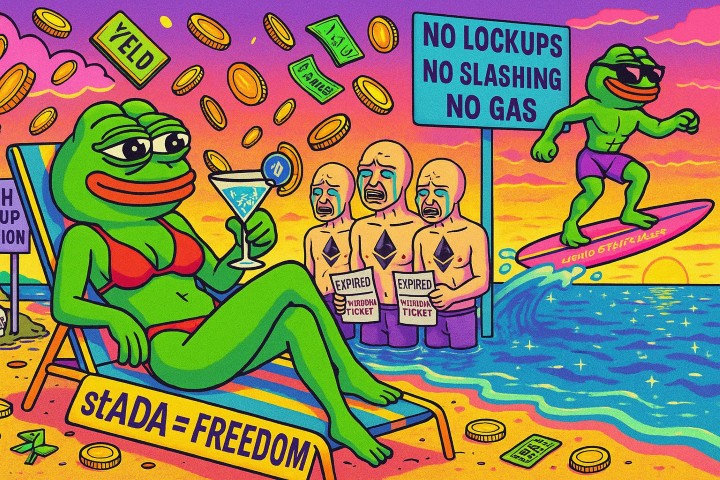

That’s liquid staking on Cardano. No synthetic tokens. No unbonding drama. No slashing nightmares.

Protocols like Liqwid and others let you opt in to smart-contract-powered delegation — where your ADA stays liquid, spendable, and composable — while still securing the network.

It’s the same real staking, just with extra freedom and more yield potential.

🔥 Why It Slaps

- Capital Efficiency: Your ADA earns yield while still being usable across DeFi

- No Lockups: Unlike Ethereum (see below), you can access your funds anytime

- Double Dipping: Staking + Yield Farming = stacked rewards

- Composability: Use staked ADA as collateral, LP tokens, voting power, and more

TL;DR: You’re earning yield on your yield, and you didn’t even have to unstake.

🔒 Why ETH Staking Feels… Kinda Mid

Let’s be honest: staking ETH is a vibe kill for most users:

- ❌ Lockup Periods: You often can’t unstake or withdraw without long delays

- ❌ Centralization Risks: Most ETH staking happens via Lido or centralized exchanges

- ❌ Slashing: Validators can lose your ETH if they mess up

- ❌ High Barriers: Running your own validator = 32 ETH, high uptime, and tech expertise

Meanwhile, Cardano staking is: non-custodial, liquid, no slashing, and zero lockups.

And with Liqwid and others offering liquid staking, we now get the best of both worlds — yield + freedom.

🌉 Why This Matters for Cardano + BTC DeFi

Now imagine this setup in the context of upcoming Bitcoin integration:

- Stake your ADA → earn rewards

- Use your tokenized BTC on Cardano to yield farm or collateralize

- Wrap your strategy in Cardano’s security model (and soon — in privacy)

Liquid staking is the connective tissue that makes all this composable and capital efficient.

ADA doesn’t just sit. It moves, earns, and builds.

🕶 Enter Midnight: Privacy + Liquid Staking = 🔥

Liquid staking will get even more powerful once it meets Cardano’s upcoming Midnight network.

Why? Because staking yields, positions, and DeFi flows will become programmably private — not just visible to everyone like on Ethereum or Solana.

- 🕵️ Stake ADA privately

- 💸 Use liquid staked assets inside Midnight apps

- 👻 Shield wallet balances and positions from public view

That’s next-gen staking: liquid + private + composable.

🧠 Final Vibe Check

It’s like earning apprx. 2-3% while your friends are double-yielding, farming, looping, and unlocking composable rewards across the Cardano and Bitcoin ecosystems — all while staying liquid. Check out the rewards calculator here.

Are you still staking like it’s 2021? Or are you about to unleash your ADA’s full potential in DeFi, Bitcoin, and beyond? Let us know 👇