Imagine if Satoshi Nakamoto and a Cardano Degen went on a Tinder date, bridged their chains, and made a yield baby. That baby would be BTCGrow — the protocol that just let you stake your BTC with zero lockups for real yield… and it actually worked.

Sounds fake, but here we are: you stake BTC → get wrapped into wanBTC → earn yield on Cardano → withdraw BTC whenever. Let’s unpack this magic vending machine for Bitcoiners. 💣

🧠 Wait… Staking BTC? How?

BTCGrow uses WanBridge to wrap native Bitcoin into wanBTC (think: wBTC’s chill cousin), which is then deployed on Cardano using smart contracts. That wrapped BTC is routed into a DeFi lending pool like the “Danogo Flexible Lending Pool.”

From there, users earn passive income — with no centralized custodian, no lockup, and no slashing risk. The whole thing is non-custodial, transparent, and based on Cardano smart contracts.

📊 Real-Time Stats (from a real stake)

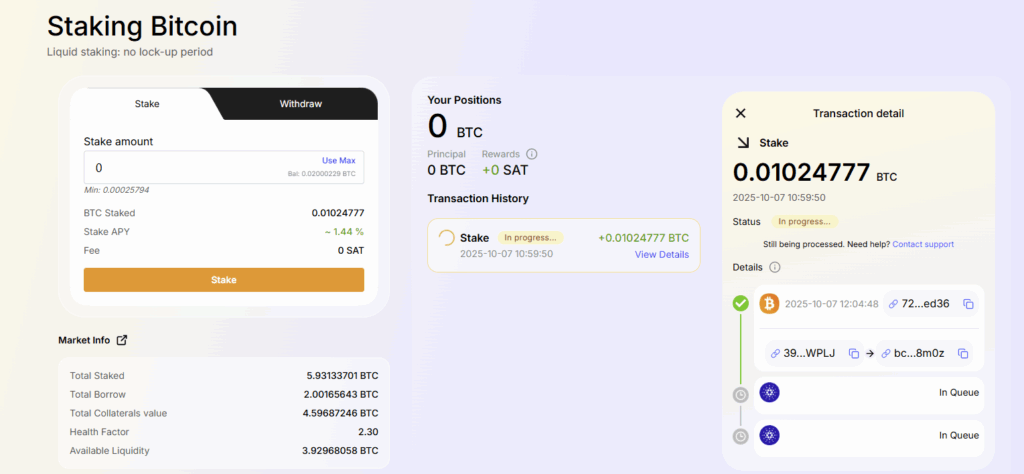

Here’s what the dashboard shows after a live stake:

| 📌 Metric | 🔢 Value |

|---|---|

| Total BTC Staked | 5.93133701 BTC |

| Total BTC Borrowed | 2.00165643 BTC |

| Total Collateral Value | 4.59687246 BTC |

| Available Liquidity | 3.92968058 BTC |

| Health Factor | 2.30 |

| Stake APY | ~1.44% |

| Fees | 0 SAT |

Time to stake: ~1 hour confirmation time (in progress). Not instant — but no weird errors, and everything is transparent on-chain.

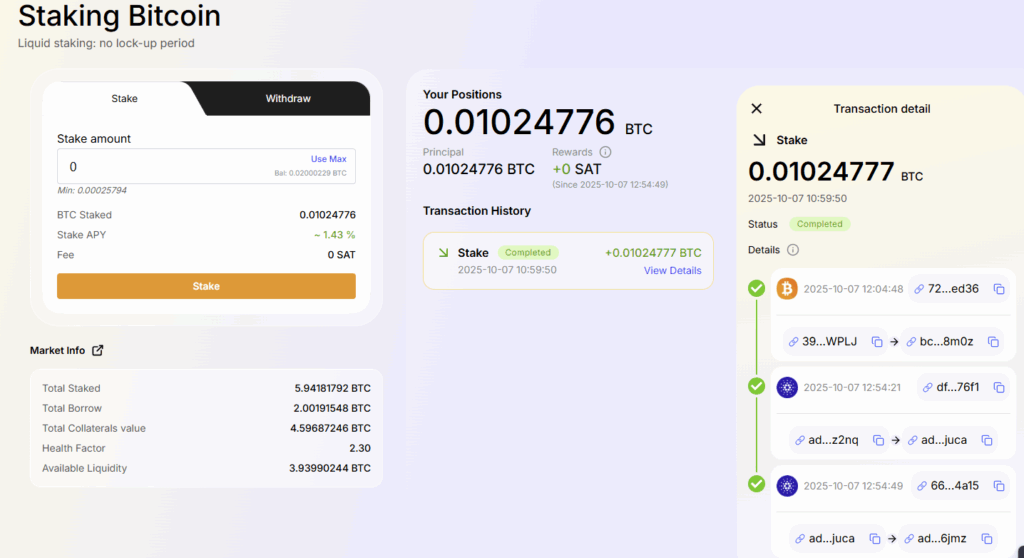

We will update you on the returns we are generating thru Bitcoin Staking – The Staking confirmation took about 90 minutes mainly because of the slow confirmation model of BTC.

🎯 Why BTCGrow Hits Different

- Liquid staking for BTC (finally)

- No lockups – unstake anytime

- 0 fees (at least for now)

- Cross-chain bridge into Cardano DeFi

- DeFi-native rewards – from actual lending demand

Yeah, it’s a little surreal. This is Bitcoin with utility, and it’s happening on Cardano. 👀

⚠️ Degen Disclaimers – Know the Risks

BTCGrow isn’t without risks. Here’s the real talk:

- Bridge risk: If WanBridge fails, so does your BTC-on-Cardano dream. (running for years w/out any issues!)

- Smart contract bugs: Cardano is secure, but smart contracts can still fail. (like every other smart contract)

- Liquidity risk: If too many borrowers or stakers pull at once, it may get messy. (bank run anyone?!)

- Yield variance: APY isn’t fixed and depends on lending pool health. (Let’s grow this together)

Current health factor is solid (2.3), but stay vigilant. No yield is risk-free, even when the UI is clean and the APY is polite.

🚀 How to Max Your Rewards

- Stake during high lending demand for max APY

- Use multiple stakes to test timing + liquidity

- Monitor collateral health and market metrics

It’s like yield-farming BTC without becoming an Ethereum gas victim. You can finally use your Bitcoin like a grown-up degen.

🎤 Final Thoughts: BTC, Meet Cardano

BTCGrow is more than “BTC staking” — it’s cross-chain DeFi, wrapped in a clean UI, with rewards that (hopefully) don’t blow up. The current APY is modest (~1.44%), but it’s in real Bitcoin. No farming funny tokens or inflated yield bait. This is straight BTC yield for doing almost nothing.

And if you’re already bullish on Cardano, this is the kind of real-world utility that shows what Midnight’s privacy layer or Cardano DeFi can do next.

Bitcoin is finally doing something — and it’s doing it on-chain. No middlemen. No friction. Just click, stake, earn.

Stake responsibly. Yield like a Degen. And stay liquid, anon. 🧪

🧠 Stake with ZEIT — Soon a Midnight Node

Support the ZEITGEIST Pool – Single Pool Operator. 0% Fees. 100% Cardano Vibes.

Would you stake your BTC like this? Or does it still feel risky? Drop your X handle and takes in the comments below 🧨

🧠 FAQ – BTCGrow Liquid Staking

Do I need to bridge or wrap my BTC?

No. You don’t need to manually bridge or wrap anything. Your BTC remains locked on the Bitcoin chain.

The cross-chain supply to Cardano is handled automatically via audited smart contracts, ensuring your BTC is always accounted for and can be withdrawn at any time.

Can I unstake anytime?

Yes. You can unstake your BTC at any time — there’s no 7-day waiting period like in other protocols.

When you withdraw, you’ll receive all the yield you’ve earned up to that moment.

What wallet is supported?

You only need a Bitcoin wallet to stake and withdraw — wallets like Unisat or OKX are fully supported.

Are there any fees?

Minimal network and protocol fees apply, used to support security and infrastructure. These are fully transparent.

Important: There is a fixed $20 withdrawal fee (in USD equivalent), charged by the Wanchain bridge when redeeming your BTC back to the mainnet. This is not a percentage — it’s per transaction.

The fee used to be around $75, but BTCGrow negotiated it down to $20. If you stake a larger amount (like 1 BTC), the fee becomes negligible over time. You can also delay withdrawals until needed to reduce cost impact.